Understanding Cloned Credit Cards and Their Impact on Business

In today’s digital landscape, the threat of cloned credit cards looms large, especially for businesses that rely on online transactions. As technology advances, so do the methods employed by fraudsters. This article delves deeply into what cloned credit cards are, the implications for businesses, and robust strategies to protect against these fraudulent activities.

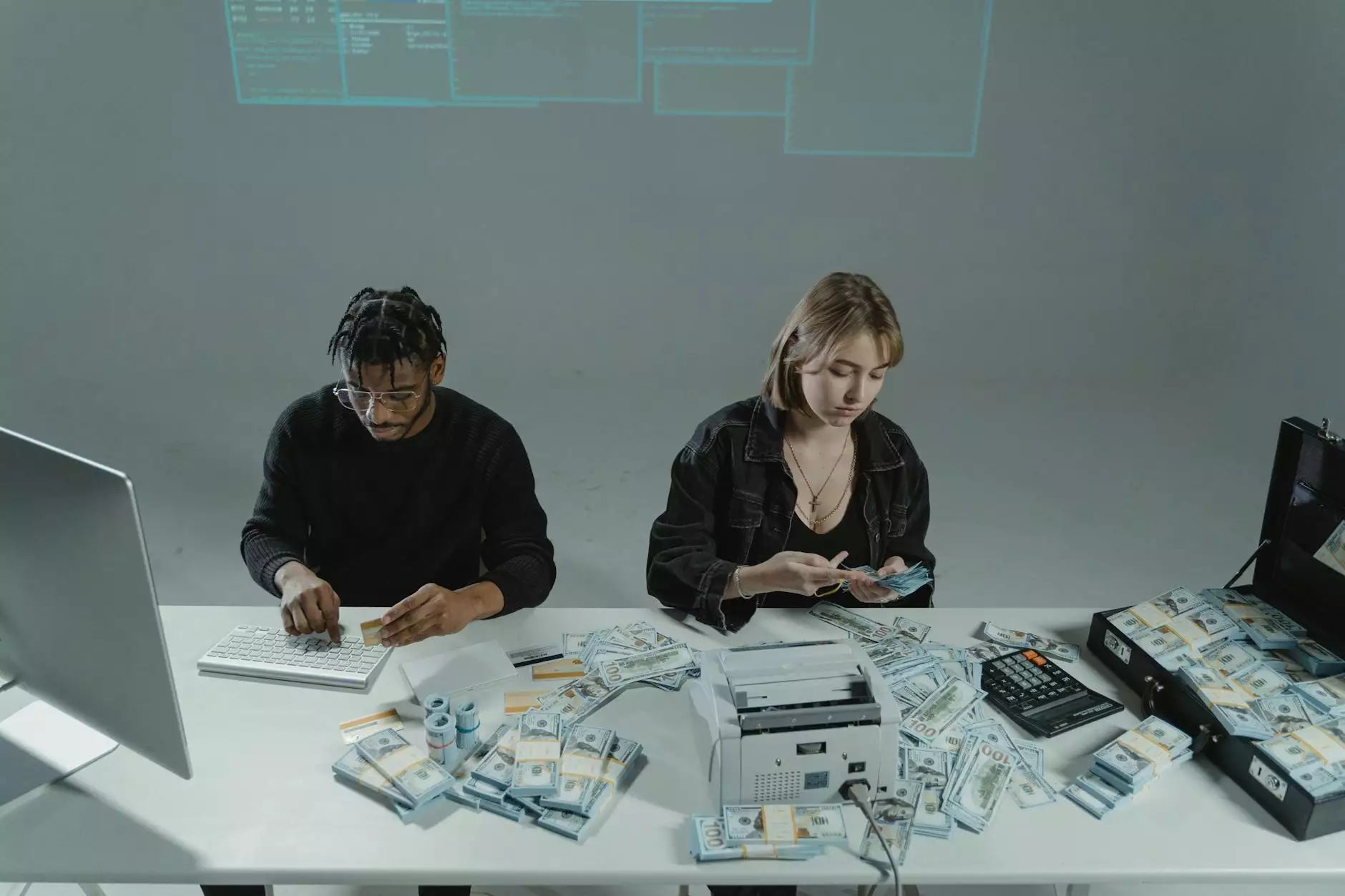

What are Cloned Credit Cards?

Cloned credit cards refer to fraudulent copies of legitimate credit cards. These copies are created using various methods, enabling criminals to carry out unauthorized transactions without the cardholder's knowledge. Typically, this process involves stealing data from a credit card’s magnetic stripe using devices known as skimmers.

How Do Fraudsters Clone Credit Cards?

The methods employed by fraudsters are often sophisticated and include:

- Skimming: This involves using a small device to capture card information when a card is swiped. Skimmers can be placed on ATMs or gas station card readers.

- Phishing: Criminals may send fraudulent emails or messages that appear legitimate, tricking users into providing their credit card information.

- Data Breaches: Hackers can infiltrate companies to obtain customer data, including credit card details.

The Business Impact of Cloned Credit Cards

The repercussions of cloned credit cards on businesses can be severe and multifaceted:

Financial Losses

One of the most immediate impacts of credit card fraud is financial loss. When a fraudulent transaction is detected, businesses often have to refund the victim, absorbing the cost of the goods or services provided. Additionally, businesses might incur chargeback fees that can add up quickly.

Damage to Reputation

In an age where consumer trust is paramount, being associated with credit card fraud can seriously damage a business's reputation. Customers may lose faith in a brand that fails to protect their sensitive financial information.

Legal Implications

Failing to adequately protect customer data can also lead to legal repercussions. Businesses are often required to adhere to strict data protection regulations. Non-compliance can result in lawsuits, fines, and increased scrutiny from regulatory bodies.

Strategies to Protect Your Business Against Cloned Credit Cards

To mitigate the risks associated with cloned credit cards, businesses must adopt comprehensive security measures:

Invest in Secure Payment Gateways

Utilizing reliable and secure payment gateways with advanced encryption can significantly reduce the likelihood of credit card cloning. Ensure that your payment processor complies with Payment Card Industry Data Security Standards (PCI DSS).

Implement Strong Authentication Measures

Employing two-factor authentication can add an extra layer of security. This process typically requires users to provide two forms of identification before completing a transaction, making it harder for unauthorized users to gain access.

Regularly Monitor Transactions

Keeping a close eye on transactions can help detect suspicious activities early. Implementing alerts for unusual spending patterns can allow businesses to respond swiftly to potential fraud.

Educate Your Staff and Customers

Providing training for employees on how to identify potential fraud can be beneficial. Similarly, informing customers about secure online practices can help them protect their information.

Technological Solutions to Prevent Cloning

Technology plays a crucial role in preventing fraud. Here are some advanced solutions that businesses can implement:

- Tokenization: This process replaces sensitive card information with a unique identifier or token that can’t be exploited by fraudsters.

- Encryption: Data encryption can ensure that even if data is intercepted, it remains unreadable to unauthorized users.

- Fraud Detection Software: Advanced algorithms can analyze transaction data for patterns suggestive of fraud and flag them for review.

Staying Up To Date with Security Practices

The landscape of credit card fraud is constantly evolving. It’s imperative for businesses to stay informed about the latest security threats and solutions. Regularly updating security protocols and investing in the latest technology can bolster defenses against cloned credit cards.

The Future of Payment Security

As digital payment methods become more prevalent, the demand for secure transactions will inevitably grow. Emerging technologies such as blockchain and AI are paving the way for enhanced security protocols:

Blockchain Technology

Blockchain offers an immutable ledger that can help in safeguarding transaction records. The decentralized nature of blockchain makes it extremely difficult for fraudsters to alter or access sensitive data.

Artificial Intelligence in Fraud Detection

Machine learning algorithms can analyze vast amounts of transaction data in real-time, identifying anomalies that may suggest fraudulent activities. This can lead to immediate alerts and actions that help in preventing transaction losses.

Conclusion

In conclusion, cloned credit cards represent a significant threat to businesses in today’s digital world. Understanding the mechanisms behind credit card cloning, the impacts on business operations, and implementing strong preventive measures are crucial steps in protecting your business and customers alike. By leveraging technology, staying informed, and fostering a culture of security, businesses can effectively combat the challenges posed by credit card fraud and enhance their resilience in a rapidly changing financial landscape.

The importance of safeguarding financial transactions cannot be overstated. As businesses continue to adapt to an increasingly digital economy, they must prioritize customer security and maintain high standards of trust.